Good Credit Score Best Practices Anyone Can Follow

Your credit score and report are the two most essential items in your life. They determine whether you can gain access to the products and services that you need to navigate through this world. A good credit score is attainable if you know the credit score best practices. We want to bless you with some tips that you can use to boost your credit score to the next level and keep it there.

Best Practices for Good Credit Score

Read through these 20 credit score best practices and use the information to bring yourself back to the financial health standing that you deserve.

1. Educate Yourself

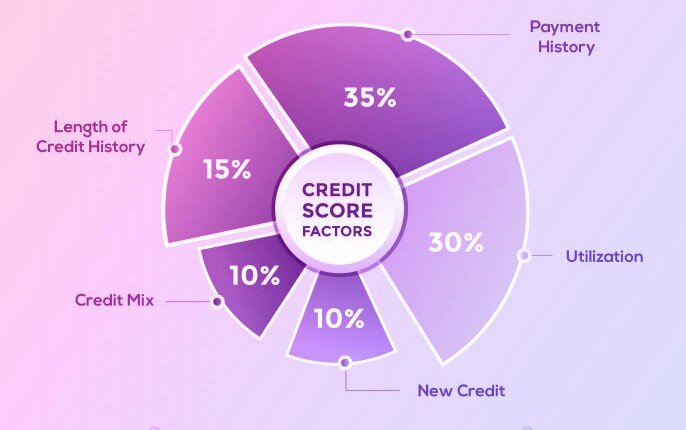

The tip on the top of the list of the credit score best practices is to keep yourself educated about credit and how it works. You need to get in-depth information on the credit scores explained. You can do that by seeking out text-based resources, or you can enroll in a good credit counseling program. People have different credit scores for a variety of reasons. One of the biggest reasons that some consumers have much higher scores than others do is that they have filled their minds with the knowledge they need to succeed. The main component of the credit score is the pie chart. The pie chart breaks down each aspect of the credit score and how much it affects the overall score. The credit score pie chart has five components, and they are the payment history, amount owed, length of credit history, new credit, and types of credit.

The payment history is self-explanatory. It's a report that reflects how timely you are with your payments. Payment history is worth 35 percent of the overall credit score. Utilization is the percentage of available credit that you use. It is worth 30 percent of your overall credit score. The length of credit history is an average of the amount of time you have had credit accounts. It accounts for 15 percent of your credit score. New credit is your newly opened accounts, and your types of credit are the types of accounts you have (revolving, installment, etc.). Each of those aspects is worth 10 percent of your credit score. Just knowing how the pie chart works can help you keep your score above water. However, you have to gain more education to become a master of your report.

2. Pay Your Bills On Time

You now know that your payment history makes up 35 percent of your credit score. Therefore, it is the most important and most heavily weighted aspect. Knowing that information, you should want to keep your payment history spotless any way you can. You can do that by making sure that you make every one of your payments on time. One of the credit score best practices you can engage in is paying your bill at least seven days before it's due. That will give your payment time to go through, and it will give the creditor time to post it to your account.

3. Pay More Than The Minimum Amount

Another one of the credit score best practices that you can use is to make large payments. The minimum payment is an amount that you can pay just to get by. It will make you look good in terms of timely payments, but it won't help much to keep your balance down. You must understand that some of the minimum payment includes interest. Thus, you only pay a small portion of the principal when you make a minimum payment. A smart move would be to pay double the amount of your minimum payment. If you can do that, then you should at least calculate the interest and then pay that amount extra with each of your payments. For example, if your minimum payment is $25, and $12 goes to the interest, you should make a $37 payment. That way, $25 will still go to the principal balance.

4. Do Not Go Beyond The Limit

Some credit cards allow you to charge your card beyond your initial credit limit. They will let you do it and then charge you an "over the limit" fee on the next billing cycle. The average "over the limit" fee is approximately $35. If you want to use credit score best practices, then you will never go over your credit limit. Potential lenders and creditors look at your spending history and balances owed. They can see when you go over your limit, and it can affect their image of you. It's better to find other ways to buy the items you desire. Take a few weeks and save up the money for something you want instead of going over your credit limit. The practice will help you to stay in good graces with all of your creditors.

5. Keep Your Utilization Numbers Low

The credit utilization number is the second most crucial aspect of your credit score. That's why keeping it low is one of the credit score best practices. Creditors like to see that you use your credit responsibly. Therefore, you must use some of your credit. However, you have to know what amount is too much.

A good "rule of thumb" practice is to keep your utilization amount under 30 percent of your available credit. Some debtors keep their utilization under 20 percent, but 30 percent is the maximum. For example, you should only use $300 from a credit card that has a $1,000 limit. Keeping your utilization low and making timely extra payments each month are two of the best ways to keep your credit score shining brightly.

6. Only Use Your Credit For Emergencies

You can preserve your credit by only using your credit cards for emergency purposes. You should never use them for frivolous purchases or items that you can buy with cash. If you save your charges for emergencies, then you'll always have available credit when serious circumstances come up. People who have high credit scores use this strategy as one of their credit score best practices.

7. Keep Accounts Open

Another one of the popular credit score best practices is to keep your accounts open even after you pay them off. The longer you leave an account on your credit report, the higher your account history will be. You must remember that the length of credit history makes up 15 percent of your overall credit score. Therefore, you'll want to leave credit accounts on your report as long as possible. You might even want to make tiny purchases on those cards from time to time and pay them back in small monthly increments just to ensure that the creditor reports the activity.

8. Keep Your Inquiries Low

Credit inquiries are not a part of the credit score pie, but they do affect your score adversely. Your credit score loses points each time a creditor performs a hard pull on your report. That means that your score will go down every time you apply for a credit card, personal loan, auto loan, or something else. The point loss can range from one point to more than five points. Aside from that, inquiries stay on your credit report for up to two years. Potential lenders can view your inquiries when they pull your credit report. They may look at you unfavorably if you have a lot of recent inquiries. Therefore, the credit score best practices involve keeping your inquiries low. Only apply for credit when you truly need it, and you've checked to see if you have a chance of qualifying for the product. You should request your credit score and then ask the potential lender what score you need to gain approval. Or we, here at Goalry, can help you by connecting you to a suitable lender based on your credit score. You just need to fill in the information below. Start now!

9. Pay Old Debts

Old debts can come back and damage your credit report if you don't take care of them. You can avoid adverse decisions if you pay them off. Your creditors might be willing to offer you low monthly payments or a debt settlement amount that equals only a portion of the debt you owe. If you pay your old debt, the creditor will have to report that you paid it on your credit report. Potential lenders will see that you have paid it off, and they will not hold it against you when they decide whether they want to assist you.

10. Consolidate If Necessary

You may want to use consolidation as one of the credit score best practices if you have more than three credit accounts, and you want to clean up your profile a bit. A consolidation has many benefits to it. First, it merges all of your accounts into one easy-to-remember monthly payment. Secondly, it will decrease the overall interest rate you have to pay. You can save thousands of dollars a year just by consolidating your debt. You can apply for a consolidation loan that we can match with the perfect lender. It can help to increase your score drastically if you obtain approval.

11. Check Your Credit Report For Errors

Another one of the credit score best practices is to check your credit report frequently. The credit bureaus have an obligation to provide you with at least one free credit report each year. You can take advantage of that obligation by ordering your report and reviewing it for errors. Make sure all of your credit accounts are yours, and the balances are accurate. Take the time to dispute anything that you feel is incorrect. Credit bureaus must complete an investigation within 30 days if you file a dispute. They must remove credit accounts that they cannot prove. Your credit score will rise if they have to remove an account from your report. Therefore, it's worth it to take the time out to check the information.

12. Dispute Suspicious Accounts

It only takes a few minutes to dispute a suspicious account that you find on your credit report, and the results can be amazing. You can open a majority of credit card disputes online. You can contact the credit bureau directly for the others. The 30-day investigation period will begin the moment you request the dispute. You will know the outcome by letter or email as soon as the bureau has an answer for you. Don't pass up the opportunity to use one of the credit score best practices. It could make a difference of an entire credit class for you.

13. Keep Your Information Up to Date

You should also make sure that tall of your personal information is up to date when you order your credit report. Make sure that your name is correct and that the bureaus have your most recent address on record. Request an update if any of the information is incorrect.

The Creditry Store - Your New Best Source of Information and Knowledge

14. Refinance Auto Loans

Refinancing your auto loan could be one of the credit score best practices that can boost your score quickly. Refinancing your car could land you with a lower monthly payment as well as a huge drop in your interest rate.

15. Keep a Good Credit Mix

Keeping a healthy mix of credit types is one of the credit score best practices to conduct. Your credit mix accounts for 10 percent of your credit score. Therefore, you should make sure that you have a decent variety. You should have one or two credit card accounts and at least one installment account, such as a personal loan or car payment. Creditors and potential lenders highly favor mortgage accounts, as well. Thus, you should invest in a home if you can get one. You will need to have a credit score of at least 580 and some money saved to make your initial down payment.

16. Open New Accounts Slowly

Make sure you don't open up too many new accounts in too little time if you want to have a positive credit score. Your age of accounts goes down when you open new accounts. To keep things balanced, you should wait a year or two before you open a new account after you've been approved for one. That will give you time to establish a timely payment history on the one account, and it will push back your inquiry on the other account.

17. Be an Authorized User

Signing up as an authorized user is another one of the credit score best practices that you can use to boost your credit. This tactic works best if you have a friend or relative who has a credit card with a very high spending limit. You can increase your score by becoming an authorized user on that account. The credit bureaus will have to report the activities and balances on both your credit report and that of the original debtor. You can use the feedback you get from your authorized user status to get credit items for yourself in the future.

18. Sign Up For Credit Protection

You may not know about credit protection, but you can use it as one of the smartest credit score best practices. Credit protection allows you to recover from injury or ailment without worrying about missing payments and ruined credit scores. The insurance company pays your credit card bill for you when you experience a long-term disability. Alternatively, the creditor may suspend your account until you get back on your feet. Creditors often offer this service when debtors initially sign up for credit cards.

19. Use AutoPay

Autopay is a great way to make sure you make all of your payments on time. You can sign up to have your credit card payments come out of your bank account directly each month. You'll never miss a payment that way, and your credit score will always stay positive.

20. Earn More Income

Finally, you can always open up new income streams to raise your income so that you can pay your debt faster. Look for a part-time job that you can weave into your schedule. Take the income from that job and use it to pay extra on your credit cards each month. Your total debt will go down faster, and that will cause a jump in your credit score. Before you know it, you'll have a glowing credit score that can get you access to the things you want in life.

Final Thoughts

You can use one, several, or all of those tips as credit score best practices. You should see your score improve drastically over time if you employ some of the suggestions. If you still need further assistance, you can contact us and speak to one of our friendly agents. We are an advocate to consumers, and we help them get the financial services and products that they need and desire. We're not a lender, but we have access to a myriad of lenders that offer a broad range of financial products. We can help you find loans, information, and strategies that can take your credit score and profile to the next level. Call us and ask us how we can help you. One of our agents will be delighted to do so.