Understanding Credit Scores

There’s nothing more foundational to understanding, improving, or effectively utilizing your credit score than to know what it is – or rather, what they are. You’ve no doubt noticed many sites making many promises about delivering your free credit score to you, but they then have to stop and explain why it may not be the same as the scores creditors check when you apply for a loan or attempt to finance a home.

We’d like to begin somewhere a bit more useful by compiling for you, quickly and at absolutely no cost or commitment, your scores from the three major credit reporting bureaus – Equifax, Experian, and TransUnion. These are numbers real creditors consult when making real decisions about your options. We can then help you better understand your full credit report from each agency and where to go from there… if that’s what you’d like to do.

See, we even created overall financial wellness tools through our parent company Goalry. We’re looking to do more than connect you to a lower-interest credit card or help you find a consolidation loan for outstanding medical expenses. We proudly do those things, and so many others, but they’re part of a larger vision – a rather ambitious vision, truth be told. Goalry.com is an innovative money wellness engagement platform and a new kind of personal finance work. We’re bringing you the tools to better understand and gradually take greater control of your investments, to more effectively manage your debt, to organize your personal or small business taxes, to evaluate your real estate options, and better manage your personal wealth, be it large or small.

And yes, we’re also pretty effective and helping you find reputable online lenders who are both flexible and creative enough to help you address any short-term needs or long-term goals you decide work in your best interest. That is, in fact, something of a point of pride with us around here.

But it all starts by getting honest with yourself and any significant other in your life about your credit and your scores. It relies on your willingness to inform yourself through our blogs and tutorials breaking down circumstances or terminology you may think everyone else understands but you (they don’t). It’s easy, and it’s free, to get started. Real change, over time, however? Well, that sometimes proves a bit more challenging.

That’s OK – we’ll be here to help you through each step as much or as little as you need. Here are a few of the tools we can provide to help you manage your credit more effectively:

Immediate, 24/7 access to your credit scores or reports from TransUnion, Equifax, and Experian, plus alerts and reminders when it’s time to update your scores with ScoreSense.

Map your scores from all three bureaus going back as much as twelve months. Visualize your progress in order to better visualize your goals. If a little competition motivates you, you can even compare yourself to others in your age group or state.

Score Simulator uses the most complete data available and sophisticated analytical estimates to let you see the most likely impact on your credit score if you missed your next car payment or applied for that new credit card. See how real choices can impact your credit rating through the projections of Score simulation.

Credit scores are one of those things many of us pretend we understand better than most of us really do. Like severe-looking men circled around an open car hood nodding in concern, or the ladies’ book club right before they figure out that none of them have actually done the reading, we assume everyone else knows what’s going on and that we shouldn’t ask. And we all know that’s never a great approach! Understanding your credit score isn't always intuitive, but neither is it difficult.

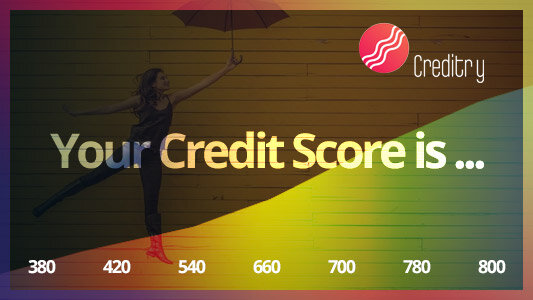

Most credit scores are in the form of a 3-digit number between 300 – 850. Because they’re intended for quick reference, minor differences aren’t that important. Creditors look at general “ranges” of scores for many purposes, such as whether to extend you credit at all, what sort of interest rate or other terms they’re willing to consider, and whether or not they’d require some form of collateral or possibly a co-signer.

The two most common types of credit score are the FICO and the VantageScore. They’re computed in very similar ways, but VantageScore is the creation of the three major credit reporting bureaus – Equifax, Experian, and TransUnion – and thus generally a more useful place to start. Each of the three agencies computes your VantageScore in the same way, but the results may vary because not every creditor reports to every agency. For instance, if you defaulted on the balance of a local department store card, the card issuer may pass this information along to TransUnion but have no direct dealings with Equifax or Experian. Obviously, you don’t want to count on this when it’s time for creditors to check your scores, but most discrepancies come from these or similar situations.

What makes for a sufficient or even a desirable credit score number varies with the sort of credit being considered, as well as the priorities of the lenders involved. There’s no universal “cut-off” for credit scores; all credit scores are part of a sliding credit score scale. Some lenders specialize in offers to patrons without an established credit history or with bad credit. They’re taking greater risks, so they tend to charge more upfront fees and higher interest rates. On the other hand, responsible use of such opportunities can be part of building or rebuilding your credit and allowing you to improve your options in the future.

Speaking in the most general terms, a “good credit score” starts in the mid-600’s, while anything over 800 is a great credit score. The highest credit score possible on most scales is 850, which makes for a nice point-of-pride, but isn’t actually necessary for real-life credit situations. The average credit score in the United States has been creeping up in recent years, and most sources estimate the American average at just under or over 700. Anything above that should get you great offers, great terms, and all sorts of flexibility. Honestly, if have a score in the mid or upper 700’s and aren’t offered terms which make you happy, you have other options and should leave that one on the table for now.

*Some of the offers that appear on this website are from companies which Creditry receives compensation. The site does not review or include all companies or all available products. All offers, logos, and company names are trademarks™ or registered® trademarks of the holders. Their use does not signify or suggest mutual endorsement, sponsorship or affiliation of or by Creditry.com or holders.