Credit Education

We’ve all heard endless times that “knowledge is power.” Sir Francis Bacon famously postulated the idea in Latin in the 17th century, and four hundred years later Schoolhouse Rock sang about it during Saturday morning cartoons. Since that time, knowledge has rapidly transformed from a precious treasure requiring a lifetime of dedication and attention to acquire to something we have so much of that we barely know how to process any of it, let alone organize it or use it effectively.

What men used to spend lifetimes gathering, debating, sharing, and meditating upon, we can Google on our phones or pull up on Wikipedia from our tablets. If we don’t know what something means or how it works, we can access thousands of videos on pretty much any topic and find out how others might explain it. We can learn almost anything online at little or not cost, other than investing a little time and effort. Then again, chances are good at some point along the way we’ll realize that somewhere along the way we stopped digesting man’s worldwide reservoir of collective knowledge and insight and somehow ended up binging on funny kitten videos, pop song parodies, or Saturday Night Live skits from the 90’s

The challenge in the 21st century isn’t finding the information – it’s organizing it, understanding it, and trying to keep it focused and effective. World history is full of men and women who devoted their lives in the pursuit of facts and insights; we have an app on our phones for that but still can’t figure out why our credit card balance never goes down or whether or not we should refinance our mortgage.

Effective personal credit management starts with personal credit education. Unlike Sir Bacon and friends, however, you don’t have to devote your life to uncovering the facts or analyzing their implications. Goalry has always believed that with the right information, tools, and opportunities, most of us are quite capable of taking more effective control over our personal or small business finances – and through that, our lives. Part of providing that opportunity is making sure you have access to a curated library of financial information, organized and easily accessible, covering almost any conceivable topic related to your personal or small business finances.

If you’re looking for kitten videos, on the other hand, you’ll have to try elsewhere.

If you want to know more about your teeth and how to care for them, you consult an expert in dentistry. If you want to know more about your mind and how it works, you consult and expert in psychiatry. When it’s time to build that outdoor brick oven, you need someone qualified in masonry.

Whether you’re wanting to better understand history, archery, poetry, or industry, you go to the experts. You gather the facts. You consider the options. The decisions, of course, remain entirely up to you.

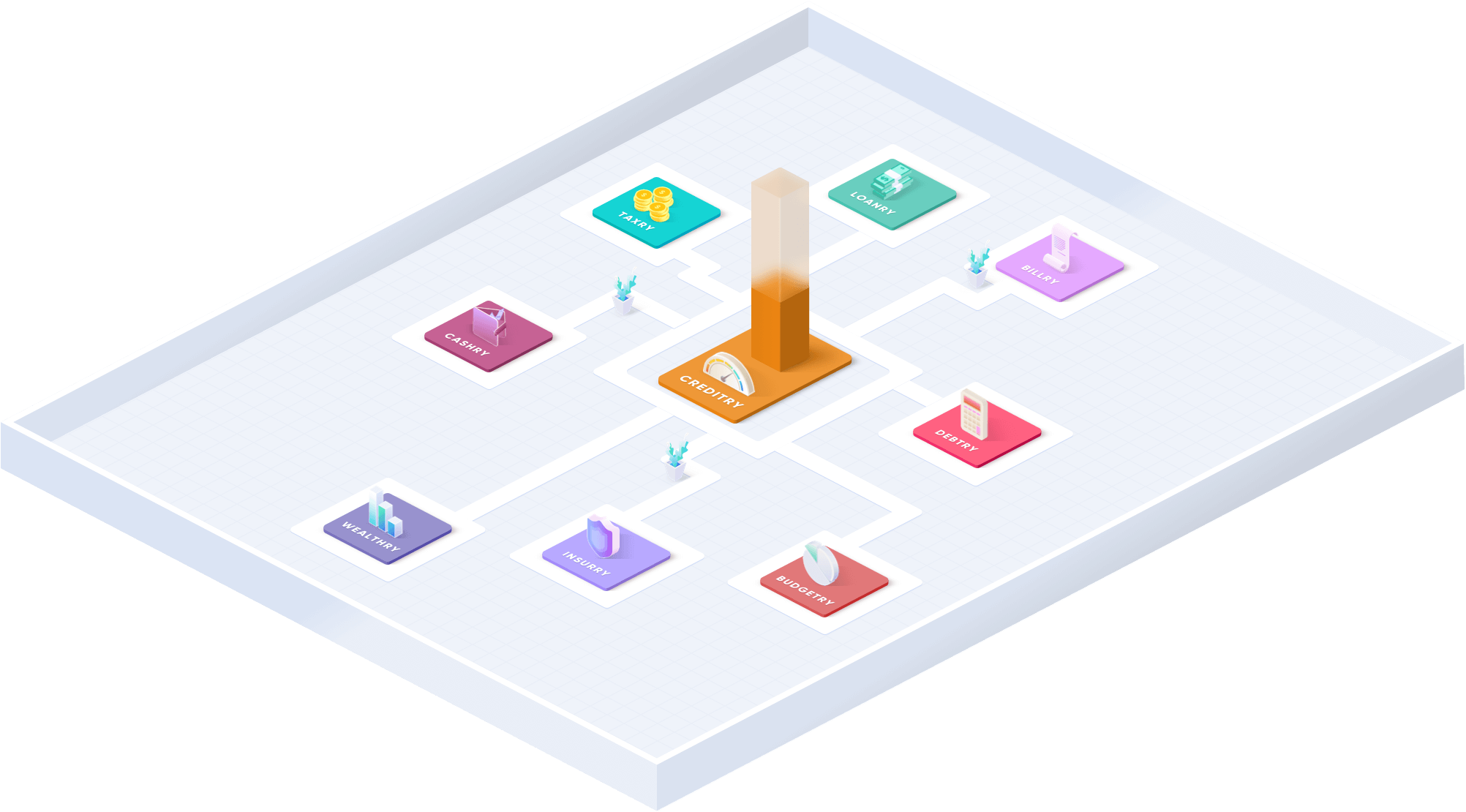

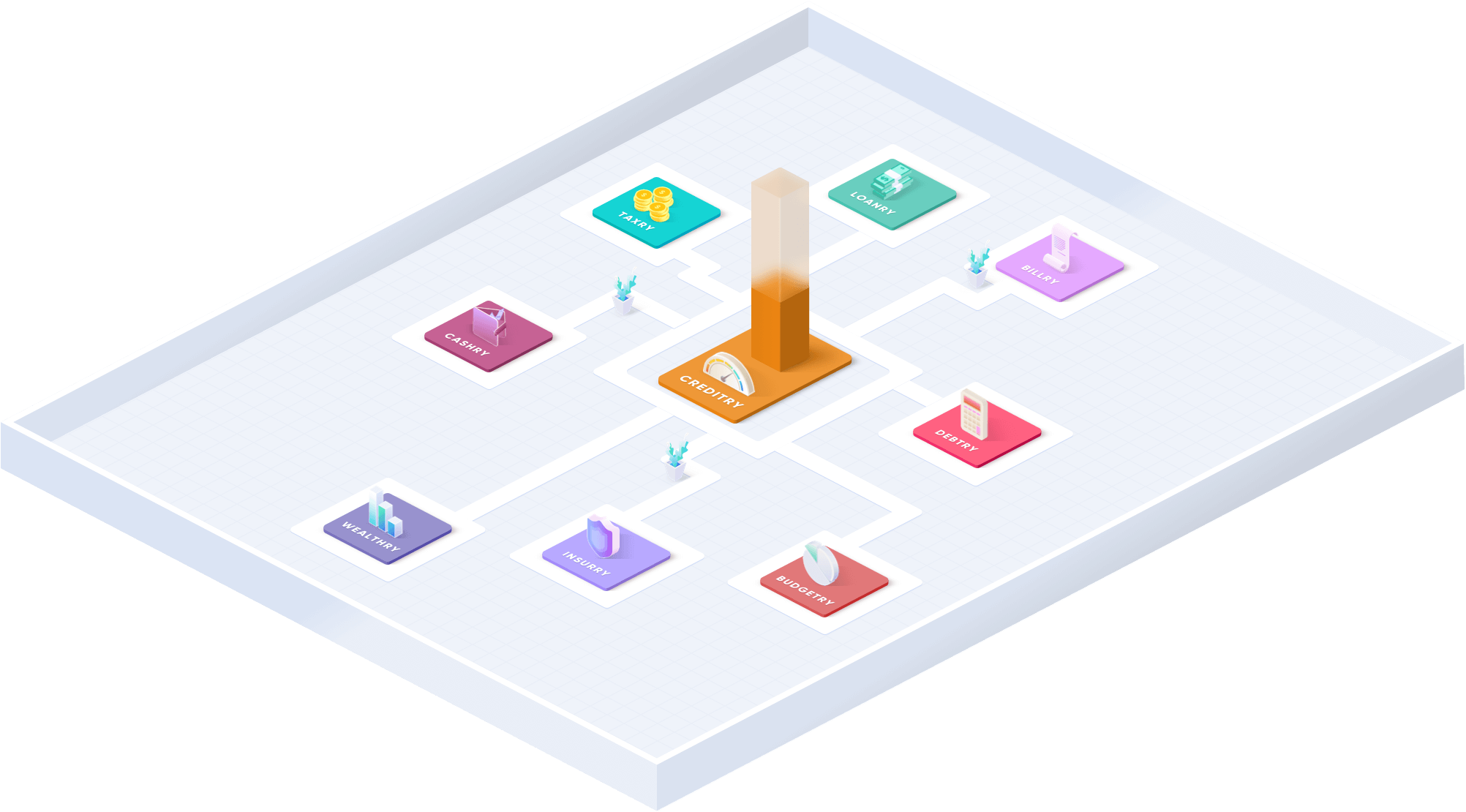

The same is true of credit, or debt – taxes, budgets, loans, or investments. Across the Goalry family, you’ll find tools for improving your personal or small business financial decisions and connections to institutions ready to partner with you in making them happen. It all starts, however, with information and education. At Creditry, that means a complete library of credit education topics, all in plain, simple English, texts or videos.

Maybe you want a short, simple answer. Most experts say 700 or higher constitutes a favorable credit score.

Maybe you’d like a little more information without things getting too involved. There are several different models for calculating your personal credit score. Generally, scores too much below 600 may make things difficult for you when applying for a loan or other form of credit. What affects credit score results varies from method to method, but generally the weightiest factor is your payment history with various creditors and your current outstanding debt-to-income ratio.

Then again, maybe you’ve realized it’s important to more fully understand the different ways credit scores are computed, the factors which shape them, and how your different credit scores are utilized to determine everything from interest rates to insurance premiums to whether or not you’re seriously considered for that promotion. Maybe you’re interested in credit score tips as stepping stones to credit score improvement. Maybe you’ve decided you want to do more than build credit – you want to build a future.

Hopefully your life is about far more than money, but for better or worse, money is a factor in almost everything. When there are so many things we can’t control and too many we may not ever fully understand, why not take control of the parts we can? Why not understand the parts which make sense once you know the information?

This is especially true with the availability of knowledge and insight combined with the power and affordability of modern technology means you could have that information and shape those factors with a few swipes or clicks. Computers in the 21st century can coordinate worldwide movements, pilot our vehicles, or allow us to defeat entire armies of zombies, aliens, or raiders. Everything your laptop, cell phone, or game system does, however, is built on a data-crunching. We can debate whether or not motherboards can think or innovate, but there’s zero doubt they can compile and analyze data and reproduce it a thousand different ways.

That means with the right credit apps or financial management tools, you can analyze spending, visualize investment potential, compare loan offers, or build credit as easily as you check your favorite social media or watch the latest Tik Tok. You probably know someone excited by how easy the latest fitness tracker makes it to monitor calories and calculate steps. Why not apply that same convenience and power to monitor spending and calculate savings? To monitor your credit reports and calculate credit score improvements? If knowledge is power, then credit education is financial power – before you save, borrow, or spend a single dime. What’s a good credit score? One you understand and know how to leverage. A good credit score is one that’s higher than it was six months ago.

Maybe you want a short, simple answer.

Maybe you’d like a little more information without things getting too involved. What sort of information is on my credit report? It’s primarily a record of various types of debt you’ve taken out and how reliably (or not) you’ve repaid or are repaying each. At the same time, there’s so much more to it than that and it can be important to understand the details. How do you resolve credit disputes? Which tips for good credit really help and which ones are just gimmicks from people trying to sell me something?

Or maybe you’ve realized it’s important to more fully understand the power of credit reports, for better or worse, over so many parts of our lives we may not always associate with our payment history. Can you add explanations to different sections of your credit report? Is my credit report the same no matter where I get it? Who has access to my credit report? How is my credit report used? These are all topics we discuss at Creditry, from many different angles but always in straightforward terms and plain, simple English.

It can seem rather tedious or frustrating to clean up your credit report, improve bad credit, or build credit from scratch. There are ways to make it happen more quickly, but that doesn’t always mean change will feel like it’s happening fast enough. We can’t make every part of it easy, but it doesn’t have to be as hard as it sometimes seems – and you don’t have to do it alone. It starts with credit education and encouragement through Creditry and the rest of the Goalry family. It continues with the tools and connections we’ve developed over the years, combining flexibility and power with intuitive design and ease-of-use.

There are so many things about our credit history that we can’t control. There are parts of the financial world we may not ever fully understand. All the more essential, then that we take control of the parts we can. Thanks to the wonders of 21st century tech, that means that the right credit apps or financial management tools can help you analyze the impact of your choices on your credit report and three-digit credit scores.

Imagine pulling up essential credit information when and where you need it or comparing your financial options quickly and easily, all with a few swipes or clicks. Imagine real-time alerts to unexpected activity from any of your accounts or changes to your credit report which dramatically heighten your credit security and confidence. You’re able to stay connected 24/7 to news, scores, and entertainment from around the world, anytime of day or night, during any weather, from anywhere. Why should your credit information and your ability to leverage credit for your own goals and needs be any different? If knowledge is power, then credit education is financial power – before you fill out a single application or negotiate a single interest rate.

Maybe you want a short simple answer. In this case, the short, simple answer is that there is no short, simple answer.

Credit and Identity protection services use the expertise of fraud prevention professionals and the data-processing power of technology to perpetually survey the internet, credit agency records, your various accounts, court records, and anywhere else your name or identifying information may appear without your approval. They prevent inappropriate use when possible and notify you immediately when prevention isn’t possible. Prompt reaction to credit or identity violations is often key to preventing or minimizing the damage done to your finances, your credit, and your good name.

Different services provided different types and different levels of service, so it’s important that you know what questions to ask and what services are reasonably expected of the latest products.

Ideally, you’d utilize an app or program which is both powerful and flexible enough to adapt to your specific circumstances and needs and intuitive enough that you don’t have to take an entire course in how to use it. You should be able to choose how frequently you’d like to receive which sorts of alerts, and it should integrate seamlessly with other financial apps you’ve chosen to utilize.

Technology is wonderful, but the more you understand about your credit, the different ways it’s used, and the things you can do apart from outside services to protect yourself, the better off your credit will be and the more options you’ll have moving forward.

Whether you’re trying to build credit from scratch, repair bad credit, or strengthen an already decent credit score, credit education is key. We’ll always argue that the best credit score tips are the most obvious: don’t spend more than you can afford and pay your bills on time. The difference is, we’ll walk you through practical ways to help those things happen – how to create an effective budget, appropriate vs. reckless credit card utilization, ways to cut costs in little ways that add up quickly over time, etc.

While most of us can make substantial headway in paying down debt just by getting organized and making practical adjustments, in some cases a debt consolidation loan or other financial restructuring might be appropriate to consider. Credity and our sister sites are packed with information and insights, including the pros and cons of almost every conceivable approach.

Yes ,we’ll also cover tips for good credit: why you might not want to close your credit cards after you pay them off, which choices are most likely to nudge your score up or down a few points, and anything else you may find helpful. We’re here to provide information, not decide the right course for you. Full disclosure, however – we’ll probably encourage you to focus on the substantive steps most likely to build your long-term creditworthiness and personal happiness and security.

Knowing what affects credit score calculations is handy. Credit tips and tricks are nice and have their place. There’s really no substitute, however, for committing yourself to ongoing credit education. There’s no app, no trick, no insider information that can replaced substantive change and personal commitment towards using the available information, tools, and connections to take small steps towards big, fundamental changes in how you approach your personal or small business finances.

How does a home equity loan work? Is it better for my small business to keep debt low or to build up savings against any future downturns? Does it matter whether I choose APR or fixed-rate interest? How do I know whether or not real estate in my area is worth what the seller is asking? Can people in my financial position even afford to think about investing towards retirement, or should I focus on other things for now and worry about that later?

We’ll never try to tell you what you should do. We will, however, gladly offer our years of insight and expertise to help you make the most informed decision possible. We’ll connect you to reputable lenders if you desire, and provide online tools and cutting-edge applications for taking more effective control of your personal or small business finances. And once you choose to be a part of the Goalry family – even if you prefer that be only a small part – you’ll have complete access to all ten Goalry “stores” with a single username and password of your choosing.

We’ll say it again – managing your credit and working towards more effective control of your finances may not always be easy. The most important sorts of growth rarely are. But it doesn’t have to be as difficult as it often seems, and you don’t have to do it alone.